arizona vs nevada retirement taxes

Growing fast the estimated 2018 Nevada population was 3034392 and New Mexicos population was the smallest at 2095428. Florida No income tax low cost of living and warm.

Arizona Or Florida Which Should You Retire In 2021 Aging Greatly

However there are a few places that are more expensive like Kingsbury and Gardnerville.

. States With The Lowest Taxes To Save Retirees Money. Property tax per capita. 4 on taxable income up to 10000 895 on taxable income over 1 million.

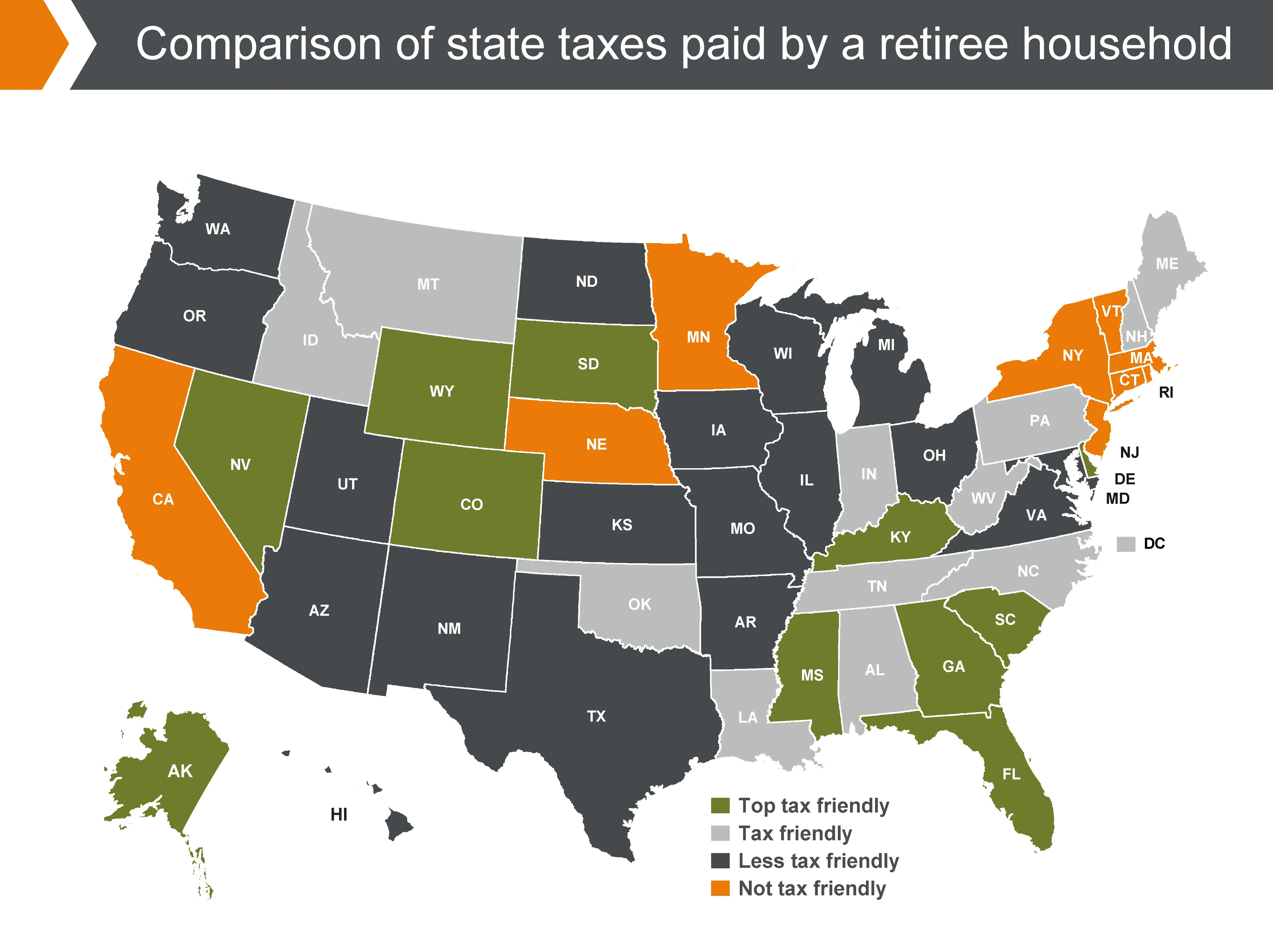

At one time or another pretty much everyone approaching retirement or early in retirement. The tax burden in Arizona is small compared to that of other states because of its lower-than-average. For more information about the income tax in these states visit the Arizona and Nevada income.

In 2020 18 of AZs population was 65 or older while Florida had many more with 209 of the population 65. The state sales tax is. Are other forms of retirement income taxable in Arizona.

323 on all income but Social Security benefits arent taxed. Like in California different cities and municipalities often add in local sales taxes. The state sales tax in Nevada is 46 which is 265 lower than its neighbor to the west.

Nevada is a tax-friendly state making it ideal for many retirees. Retiring in Nevada comes with pros and cons. The median income is almost the same around 52000 with Nevada in a slight advantage.

The influx of new residents combined with tourists can cause crowding even in small towns. Youll pay no regular or retirement income tax and Nevada property taxes are low. However Arizona wins points for having no estate or inheritance.

Its 2020 population was 7728717 as compared to Floridas 21477377. Ad If you have a 500000 portfolio download your free copy of this guide now. The biggest advantage is low taxes and many might also like the weather the abundance of things to do and the many retirement.

This tool compares the tax brackets for single individuals in each state. State Income Tax Range. State tax rates and rules for income sales property estate and other taxes that impact retirees.

The exemption increase will take place starting in January 2021. In order to determine the best and worst states for military retirement WalletHub compared the 50 states and the District of Columbia across three key dimensions. The age statistics suggest that Arizona.

29 on income over 440600 for single filers and married filers of joint returns 4 5. There are a few things that make Nevada stand out as a great place to retire. In Florida 4340 of older renters spend less than 30 of their income on housing compared to 5290 in Arizona.

Nevada is also devoid of estate and inheritance taxes and has some of the countrys lowest median property tax rates. Increased the exemption on income from the state teachers retirement system from 25 to 50. Beginning in 2022 the highest rate will be 1075 on taxable.

Since Nevada does not have a state income tax any income from a pension 401k IRA or any other retirement account is not taxable. For homeowners Arizona is still the more affordable option. For more information about the income tax in these states visit the Arizona and Nevada income tax pages.

Nevadas general and retiree population continues to increase year after year. Income from retirement savings accounts like a 403b or a 401k is taxed as regular income by the state of Arizona. This can represent significant savings when compared.

Ad If you have a 500000 portfolio download your free copy of this guide now.

Leaving California Best Places To Retire Cost Of Living Prescott

Arizona Vs Nevada Where S Better To Retire

Arizona Vs Nevada Where S Better To Retire

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Moaa 2 More States Exempt Military Retirement Pay From State Income Tax

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Is It Better To Retire In Arizona Or Nevada Senior Living Headquarters

Arizona Retirement Tax Friendliness Smartasset

Arizona State Taxes 2022 Tax Season Forbes Advisor

10 States That Attract The Most Retirees Voting With Their Feet Best Places To Move Best Places To Retire Retirement

Arizona Retirement Tax Friendliness Smartasset

Benefits Of Personalloan Personal Loans How To Apply Personal Finance

Tax Friendly States For Retirees Best Places To Pay The Least

Kiplinger Tax Map Retirement Tax Income Tax

Arizona Retirement Tax Friendliness Smartasset

Reasons To Move From Ca To Az Prescott California Best Places To Retire